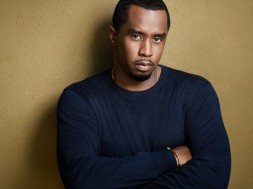

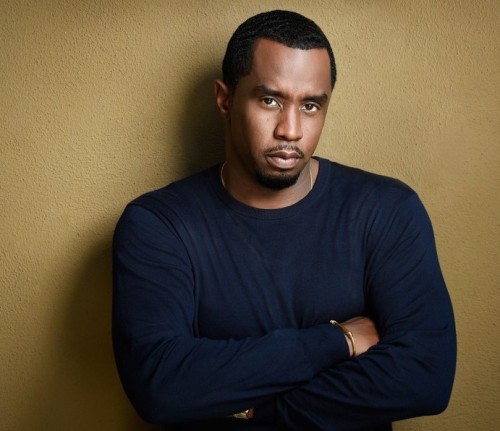

Sean ‘Diddy’ Combs launches ‘Our Fair Share’ to Help Minority-Owned Small Businesses Access Second Round of PPP Funding

NEW YORK – Entrepreneur and Media Mogul Sean ‘Diddy’ Combs launched OURFAIRSHARE.com, a platform built to help minority entrepreneurs and small businesses access much-needed capital amid the economic devastation brought by COVID-19.

The initial round of Paycheck Protection Program (“PPP) dollars disproportionately went to those with the right connections, rather than the greatest needs, Our Fair Share will help minority-owned companies learn about the PPP and get connected to approved Small Business Association (SBA) lenders that can process applications for these potentially business-saving loans.

“COVID-19 is devastating our communities and without access to stimulus funding we risk losing critical businesses that create jobs and help build opportunities and wealth in our communities.” said Combs. “I created Our Fair Share to help entrepreneurs play on an even playing field and give them a chance to survive with the hope to thrive.”

Combs further announced a partnership with the National Bankers Association, the trade group representing minority-owned financial institutions, to connect minority-owned banks and financial technology companies to the Our Fair Share platform and enable these banks to originate PPP loans from applicants that utilize the site.

Our Fair Share is designed to help ensure diverse small businesses, independent contractors and nonprofits, to understand that they are eligible and how to apply for PPP. This provides clear information about the requirements for a successful application. The applications are connected to approved PPP lenders. The lead institutions are: The Harbor Bank of Maryland, based in Baltimore, MD, Liberty Bank and Trust, based in New Orleans, LA, Carver State Bank, based in Savannah, GA, and Lendistry, an online small business lender based in Los Angeles, CA.

Combs also shared a longer-term vision for Our Fair Share as a connector for entrepreneurs searching for capital and capital providers. The platform will be dedicated to getting funding into the hands of the entrepreneurs that need it and will evolve to meet the needs of the minority small business community.

“It is inspiring to see a cultural icon like Sean Combs partnering with minority banks and others to ensure economic opportunity for minorities in this program”, says Kenneth Kelly, Chairman of the National Bankers Association. Our leaders in economics, politics, and culture must unite because the COVID-19 healthcare and economic impacts on our communities are interrelated. We can help our communities weather this storm if we work together.”

On Tuesday, the Senate passed $484 billion in new pandemic relief funds to provide additional funding to the PPP small business aid program, pay for coronavirus testing and help hospitals deluged by sick patients. The PPP is a part of the Coronavirus Aid, Relief and Economic Security (CARES) Act, the $2 trillion stimulus package the US Congress approved on March 27, 2020 to combat the impact of the COVID-19 pandemic.

The new package would provide $320 billion to allow the PPP to take new applicants for the program, which provides forgivable loans to small business that keep employees on the payroll for eight weeks. In addition, $30 billion of the PPP loan funds are set aside for banks and credit unions with $10 billion to $50 billion in assets, and another $30 billion is set aside for even-smaller institutions.

Combs also extended an invitation for major financial institutions to partner with Our Fair Share.

“Minority businesses have always struggled to access the capital they need to thrive. Now is the time to show commitment to the communities being hit the hardest by the COVID-19 pandemic. I look forward to working with the institutions that want to help,” said Combs.

For more information about the program visit www.ourfairshare.com.

About Combs Enterprises

Combs Enterprises is the portfolio of businesses and investments built and cultivated by music legend and entrepreneur Sean “Diddy” Combs. Established in 2013, Combs Enterprises includes the brands Bad Boy Entertainment, Sean John, Combs Wine & Spirits (Cîroc and DeLeon), AQUAhydrate, Janice Combs Publishing, REVOLT Films and REVOLT MEDIA & TV, Capital Preparatory Charter Schools and the Sean Combs Foundation. Combs Enterprises is known worldwide for its award-winning, market-defining successes in music, fashion, fragrance, spirits, marketing, film, television, media and more. For more info visit: http://www.combsenterprises.com.

About the National Bankers Association

Founded in 1927 as the Negro Bankers Association, today, the association has expanded its membership to also include Hispanic-American, Asian-American, Native American and women – owned banks. Member banks are located in twenty-two states and the District of Columbia.

Recognized as the voice of minority banking in the U.S., the NBA continues its role as chief advocate for these banks in the nation’s capital.

For more information, please visit: www.nationalbankers.org.

About Harbor Bank

Founded in 1982, the Harbor Bank of Maryland is a Maryland Chartered Commercial Bank designated as a Community Development Financial Institution (“CDFI”) and African-American Minority Depository Institution (“MDI”), which is actively engaged as a SBA 7(a) lender. Harbor and its affiliates are engaged extensively across federal capital programs focused on low-income and rural communities as a USDA lender, EB-5 Immigrant Investor Program Regional Center, and New Markets Tax Credit Community Development Entity. Harbor also provides a range of financial services through its convenient branch locations and online platform.

About Liberty Bank and Trust

Liberty Bank, headquartered in New Orleans, LA, was founded in 1972. Liberty has grown from an initial asset base of two million dollars ($2 million) to approximately six hundred, twenty-five million dollars ($625 million). Liberty Bank is among the top 3 largest African-American owned financial institutions with now a nine (9) state footprint in the United States.

About Carver State Bank

Carver State Bank was founded in 1927 in Savannah, Georgia. As a certified Community Development Financial Institution (CDFI), Carver has embraced its mission, which is “Providing the Building Blocks to Financial Freedom” by offering commercial and consumer deposit accounts and loan products, including SBA and other small business loans, together with sophisticated tools like New Markets Tax Credits, which the bank deploys in urban and rural communities across Georgia.

Under the steady leadership of Robert E. James, who has been President since 1971, Carver constantly works to provide innovative financial services and support to the communities it serves. For more information, please visit: www.carverstatebank.com

About Lendistry

Lendistry is a minority-led CDFI and CDE small business and commercial real estate fintech lender. Lendistry ranks second nationwide in SBA Community Advantage lending, providing responsible financing to small business owners and their underserved communities. Lendistry is a member of the Federal Home Loan Bank of San Francisco, headquartered in Los Angeles.